For comparison, Huawei shipped 105 million smartphones in China for 26.4 percent share. The latest IDC report said Xiaomi has shipped 52 million smartphones in China for 13.1 percent market share in 2018. Xiaomi CFO Shou Zi Chew said that sales from outside of China made up 40 percent of the company’s revenue in the fourth quarter of 2018, adding that global expansion would be a priority for 2019. Xiaomi posted revenue of 44.4 billion yuan (+27 percent) and net profit of 1.85 billion yuan ($275.59 million) in Q4 2018. The global smartphone market, according to IDC, fell 4.1 percent in 2018. Market research firm IDC said Xiaomi smartphone sales volume reached 118.7 million units, representing an increase of 29.8 percent, in 2018. Xiaomi’s revenue from international markets grew 118.1 percent to RMB70 billion, which accounted for 40 percent of total revenue in 2018 vs 28 percent in 2017. Xiaomi reported revenue of RMB113.8 billion (+41.3 percent) from smartphone business, RMB43.8 billion (+86.9 percent) from the IoT and lifestyle products, and RMB16 billion (+61.2 percent) from Internet services segment. Black Shark, Meitu, and POCO brands will target games users, female users, and tech enthusiasts, respectively.Ĭhina smartphone maker Xiaomi reported revenue of 174.9 billion yuan (+52.6 percent) and net profit of 8.6 billion yuan (+59.5 percent) in 2018.

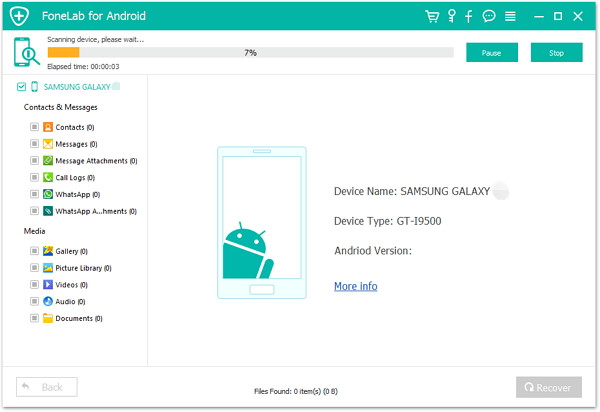

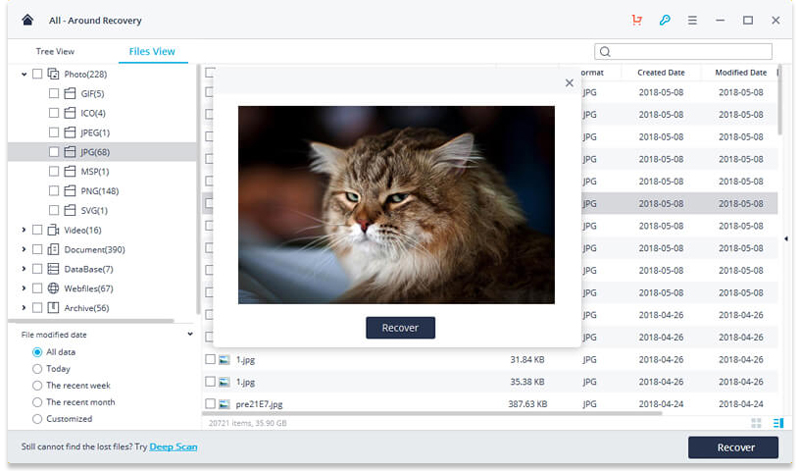

Shining samsung data recovery Offline#

Xiaomi brand will focus on advanced technologies, building online and offline new retail channels. Xiaomi has adopted a multi-brand strategy for smartphones. ASP of smartphones in foreign markets recorded 9.7 percent growth. The ASP of 3 smartphones in China increased 17 percent. Revenue generated by smartphones sold for RMB2000 or more accounted for 31.8 percent of the total revenue of the smartphones segment. Xiaomi achieved growth in the revenue from mid- to high-end models. Xiaomi launched several flagship smartphones such as Mi 8 and Mi MIX 3. Xiaomi has strengthened its market position in the mid- to high-end range smartphone market in mainland China. Xiaomi’s AI assistant has been activated on more than 100 million smart devices as of December 31, 2018. The number of connected IoT devices excluding smartphones and laptops on its IoT platform has reached 150.9 million units. Xiaomi plans to invest over 10 billion yuan in artificial intelligence throughout the next five years. Money from other hardware made up 25.1 percent while internet services made up 9.1 percent. Sales from smartphones made up 65.1 percent of Xiaomi’s overall revenue in the fourth quarter. In February, upon the launch of Xiaomi’s new flagship Mi 9 phone, founder Lei Jun said the device would be the company’s last such handset priced at under 3,000 yuan ($446.99). In China, the average selling price of the company’s phones increased 17 percent, while overseas they increased 10 percent, according to the company’s earnings report. Xiaomi has revamped its smartphone line-up, paving the way to sell more expensive devices that can raise profit margins.

Shining samsung data recovery series#

Its Redmi series devices continue to lead in emerging markets, but its Mi Mix/Max/Pro devices are increasingly becoming flagship contenders with attractive price points. IDC said Xiaomi has done exceptionally well in a few markets in Western Europe, most notably Spain. Samsung Electronics Co-CEO Kim Ki-nam said at the AGM that the company expects a tough year due to trade tensions, slowing economic growth and softer demand for memory chips from data center companies. “With a barrage of 5G smartphones right around the corner, it will be interesting to see if Samsung has enough in the tank to weather the competitive environment and maintain the top spot in the market,” said IDC. Samsung’s global smartphone volumes dropped 8 percent to 292.3 million in 2018.

Samsung’s market share reached 18.7 percent, just a few points above Apple and Huawei. Samsung smartphone volumes declined 5.5 percent in Q4 2018 to 70.4 million units. Xiaomi shipped 122.6 million smartphones for 8.7 percent share last year. Samsung shipped 292.3 million smartphones for 20.8 percent share in 2018. Its innovation has also taken a beating in the last two years. Samsung is still relying on retail shops and channel presence for boosting its smartphone shipments. Samsung is slow in adopting to online demands in major smartphone markets. Xiaomi has a strong strategy to bolster its smartphone business as compared with Samsung, the #1 smartphone brand in the world.

0 kommentar(er)

0 kommentar(er)